The company would want to evaluate their collection process and their credit issuing process.

Alternatively, it could mean that the company isn't doing a very good job in selection who they issue credit to. This would indicate that ShoeBurger is not doing a very good job of enforcing the policy and ensuring collection of payments. Based on the example above, customers are taking almost 60 days to pay - two times longer than the policy! If we were to use an industry norm, or average, of maintaining a 30 day credit payment policy, the example above would be viewed as unacceptable. While it is important to understand industry averages when taking this value into consideration, as each industry has their own "norm's," many industries have N30 terms (a 30 day payment policy). This means on average it takes the business 58 days to collect (receive) payment on credit issued. To convert this to the average number of days it takes the company to collect payment we would divide the number of days in a year by the turnover 365/6.3 = 57.93 days. Given this information, Shoeburger Corp has an A/R Turnover of 6.3, this means that the business, on average, collects their receivables 6.3 times per year. Based on this information, we can calculate the accounts receivable turnover ratio for the previous accounting period. On January 1 of the previous year the business reflected $70,000 in accounts receivable on the balance sheet and on December 31 (for the same calendar year) ShoeBurger Corp had $57,000 accounts receivable. ShoeBurger Corp had $400,000 in net credit sales for the previous calendar year (CY). For the purposes of the example below we assume the business operates on a calendar year (also referred to as CY). A company's fical calendar is determined by the company and it is used for reporting their accounting status and for how they handle taxation. A calendar year would be Jan 1 - Dec 31, whereas a fiscal year may be April 1 - Mar 31. It's important to note that a business can operate on their own fiscal year, which may not be the same as a calendar year.

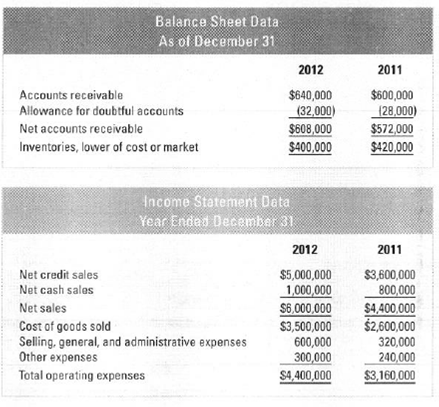

Divide net credit sales by average accounts receivable.Ĭalculating the Accounts Receivable Turnover The Accounts Receivable Turnover Ratio is calculated with net credit card sales and the average accounts receivable note that the time periods must be the same. For example, (A/R as of Jan 1 + A/R as of Dec 31) ÷ 2. Add the beginning and end, then divide by 2 to calculate the average. **The accounts receivable (also referred to as A/R) is listend on the balance sheet in the assets section and it is based on the receivable value at the beginning of a period and end value of a period. Net Credit Sales / Average Account Receivables

0 kommentar(er)

0 kommentar(er)